Royal Caribbean talks record demand, Red Sea attacks, competing with land vacations, & more

In:During a conference call on February 1, Royal Caribbean Group stated that 2024 is poised to be the best year in the company's history from both a pricing and volume standpoint.

In addition to record demand for their products from both new and loyal guests, they're continuing to receive positive sentiments from customers and claim that cruising remains an exceptional value.

In fact, their bookings are twice as high as they were in 2019. This is due, in part, to a record-breaking wave season. Travel partners are also beating elevated expectations.

"We continue to attract new customers into our vacation ecosystem and deliver the best vacation experiences, so our guests are highly satisfied and continue to rebook and return to our brands and products," said Jason Liberty, President and CEO of Royal Caribbean Group.

Demand for 2024 builds on 2023

Despite the company's capacity increase of 8.5% with the release of new ships like Icon of the Seas and Celebrity Ascent, there's less inventory available to book in 2024 than one year ago in 2023. Additionally, there are only half as many staterooms left in Q1.

What does this mean? You're less likely to score a fantastic last-minute cruise deal than you were in the past.

"We continue to see particularly healthy demand from North America, where about 80% of our guests will be sourced this year," Liberty said.

Alaska, in particular, has been performing well. This region accounts for 6% of the full-year capacity and 15% of capacity during the summer season. They've made some exciting changes to the Alaska deployment, too, such as sending the first Edge Class vessel, Celebrity Edge, to the Last Frontier.

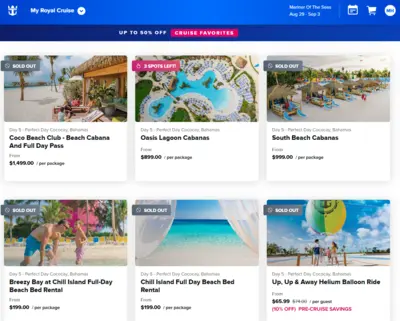

Of course, we cannot forget to mention Perfect Day at CocoCay. Roughly two-thirds of Royal Caribbean International guests sailing to the Caribbean will visit their private island in The Bahamas. Icon and Utopia, as well as the island's expansion with Hideaway Beach, will allow 3 million passengers to visit CocoCay annually.

When it comes to onboard revenue, the increase has been fueled by pre-cruise purchases. Around 70% of Royal Caribbean cruisers book at least one pre-cruise add-on before their sailing, with about 1/3 of these purchases coming through the mobile app.

"We already have about 40% more pre-cruise revenue booked in 2024 as compared to 2023," remarked Liberty.

Standing shoulder-to-shoulder with these land-based destinations

Royal Caribbean is trying to shift from offering traditional cruises to being a world-class multigenerational family option.

Icon, specifically, has been a game changer. The company really focused on its target market to create a project that people are impressed with, as they feel as though they achieved that.

With a ship like that sailing to Perfect Day with options like Hideaway Beach, they want to offer a multigenerational trip that rivals what you might find elsewhere. They've never seen such demand, pricing power, or reaction over a ship, proving that it's been extremely successful.

"When you consider Orlando, Las Vegas, and all of these other land-based options, we really believe that with ships like Icon and Perfect Day [at CocoCay], Hideaway Beach, the coming of Royal Beach Club in 2025, [and] Utopia coming straight into the short product market to Perfect Day that we are really...[starting] to attract a lot of demand from those land-based options with a better quality product, more exciting product, and great price points," said Michael Bayley, Royal Caribbean International CEO and President.

Read more: 8 things I love about Icon of the Seas (and 3 I didn't)

Red Sea update

Back in October, Royal Caribbean made the decision to cancel their 2024 Israel cruise season due to the ongoing war. At the time, they estimated that the decision would negatively impact their earnings for the year by three cents a share.

During the conference call on February 1, however, they said that while booking for the impacted itineraries was softer for a few weeks, they rebounded relatively quickly. Plus, bookings are now significantly higher than the same time last year!

Read more: Royal Caribbean cancels 2024 Israel cruise season

Finally, a long-awaited update on Allure of the Seas' dry dock

The second Oasis Class vessel was scheduled to undergo a $165 dry dock in 2020; however, this was indefinitely postponed due to the pandemic. Now, her long-awaited refurbishment is right around the corner.

"We're always modernizing," said Liberty, "...the actions we took of Oasis [and] some of the learnings on Icon [are] going to be in the modernization of Allure of the Seas."

Right now, Allure lacks some features that were added to Oasis Class ships starting with Harmony and Symphony of the Seas, including Playmakers and the Ultimate Abyss dry slide. The company has yet to reveal what will be changed.