Royal Caribbean's AI push helps explain why cruises cost more

In:Royal Caribbean Group's secret weapon isn’t new ships: it's AI. See the company's fourth quarter earnings for proof.

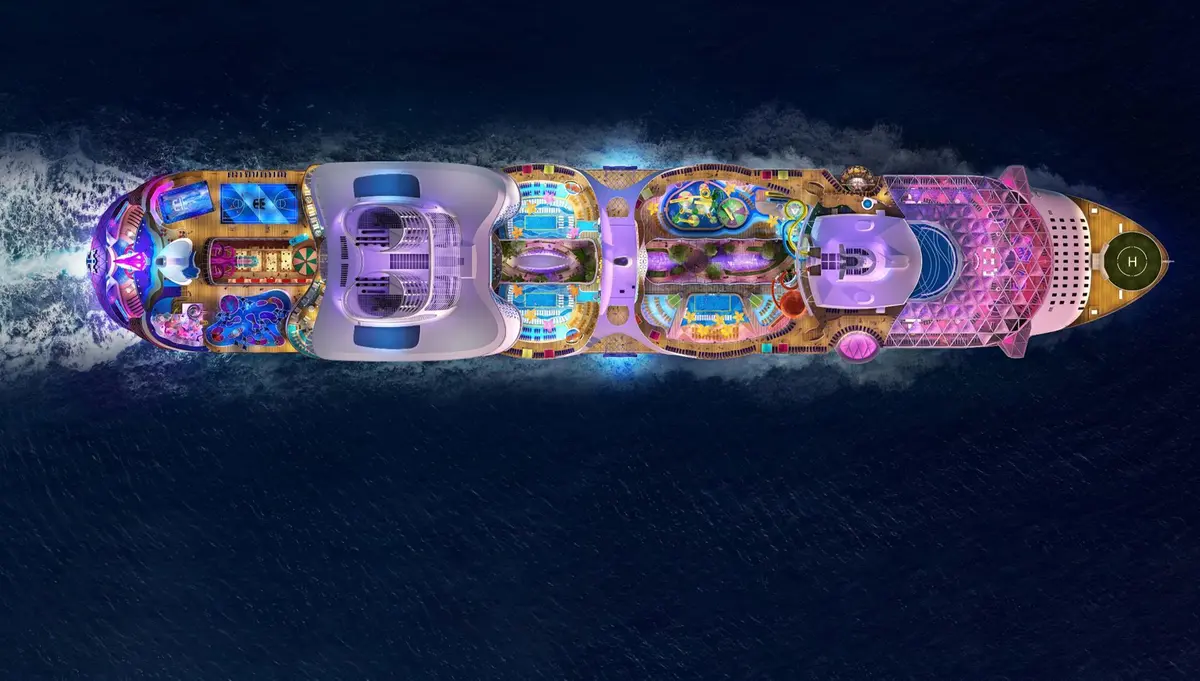

Backed by strong demand for its brands and vacation experiences, 2025 proved to be an outstanding year for Royal Caribbean.

During Royal Caribbean Group's (RCG) Q4 earnings call on Thursday, January 29, company executives acknowledged that demand for cruising remains strong.

In fact, RCG experienced the best seven booking weeks in the company's history since the last earnings call in October 2025. Approximately two-thirds of the 2026 inventory has already been booked at higher rates than in the past.

"We’re not only seeing good volume, but our pricing is higher in the Caribbean than it was last year," said Jason Liberty, Royal Caribbean Group CEO.

However, higher fares are also being driven by the company’s expanding use of artificial intelligence (AI), which has helped RCG optimize pricing in real time and determine if last-minute discounts are necessary.

Fares are higher than last year, but it's not just demand

Cruise fares have always been priced dynamically. In other words, the cost of an interior cabin on a weeklong cruise aboard Star of the Seas can fluctuate within hours based on how much inventory remains for that specific sailing.

This dynamic pricing system is standard within the cruise industry, as it helps companies balance supply and demand while keeping ships full during off-peak and peak travel periods. Recently, however, Royal Caribbean has leaned heavily into its use of AI to inform how it prices its cruises.

"Our yield management models... are AI-based," Liberty explained. "They do learn… [and] we have a pretty good handle now on close-in demand, how we market it, [and] how we price it... and our yield management and forecasting is informed by all of that."

By analyzing the data these systems collect in real-time, Royal Caribbean can increase its fares without hurting the overall demand for its products.

Read more: Analysis of cruise pricing data to find the cheapest time to book

Higher prices are sticking

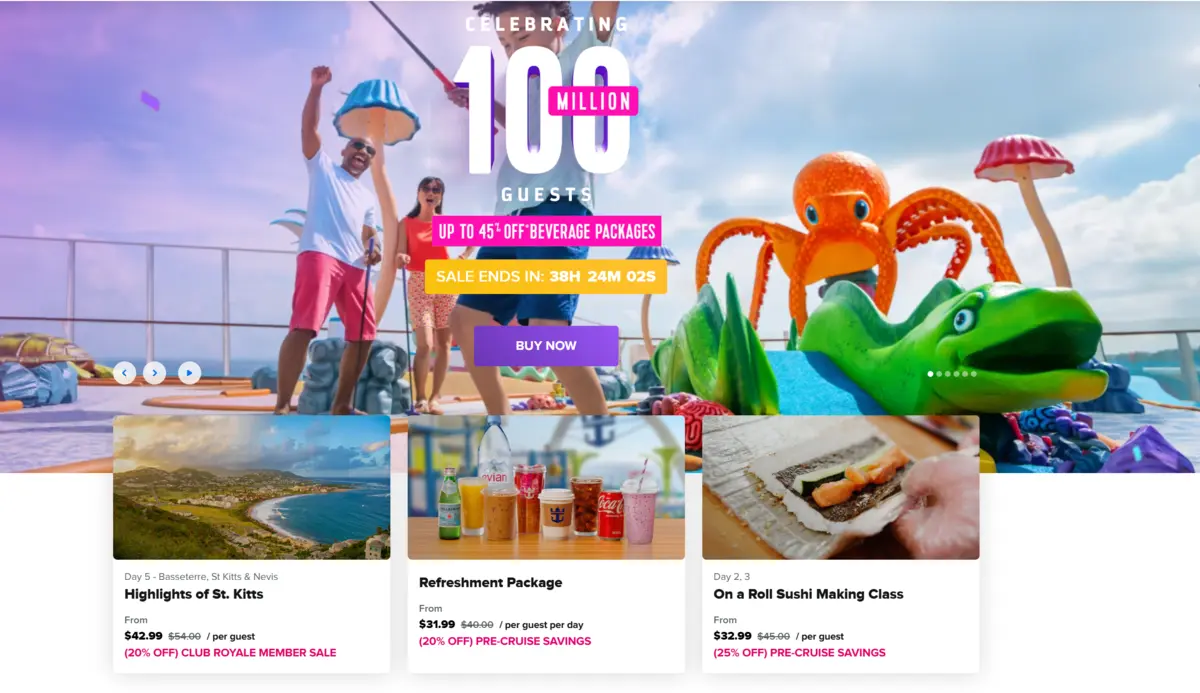

Royal Caribbean’s cruise fares are rising, but demand remains strong because travelers are willing to pay more and spend more onboard. The cruise line's latest research shows that its consumers feel financially secure and continue to prioritize experiences, with 40% planning to increase their leisure travel spending in the next year.

Not only that, but demand is exceeding capacity growth. As such, Royal Caribbean can continue raising fares while still keeping ships full, with premium experiences and onboard spending a central part of its long-term revenue strategy.

"[W]e're seeing people who are willing to pay more money than they did last year. They're willing to spend more money on the ships than they did last year," Liberty explained. "We're getting the volumes that are more than what our capacity increases, and we're benefiting from a lot of the investments that we've made."

Other ways Royal Caribbean is using AI across its operations

AI-driven pricing tools are just one way that Royal Caribbean is using artificial intelligence in its day-to-day operations.

"AI and disruptive technology are becoming a foundational advantage for us. Representing a core capability that improves the guest experience, strengthens our commercial engine, and helps us run the business more intelligently," Liberty said during the Q4 call.

Beyond pricing, the company is using AI to expand the way guests interact with its entire family of brands, not just a single line within its portfolio, such as Royal Caribbean or Celebrity Cruises.

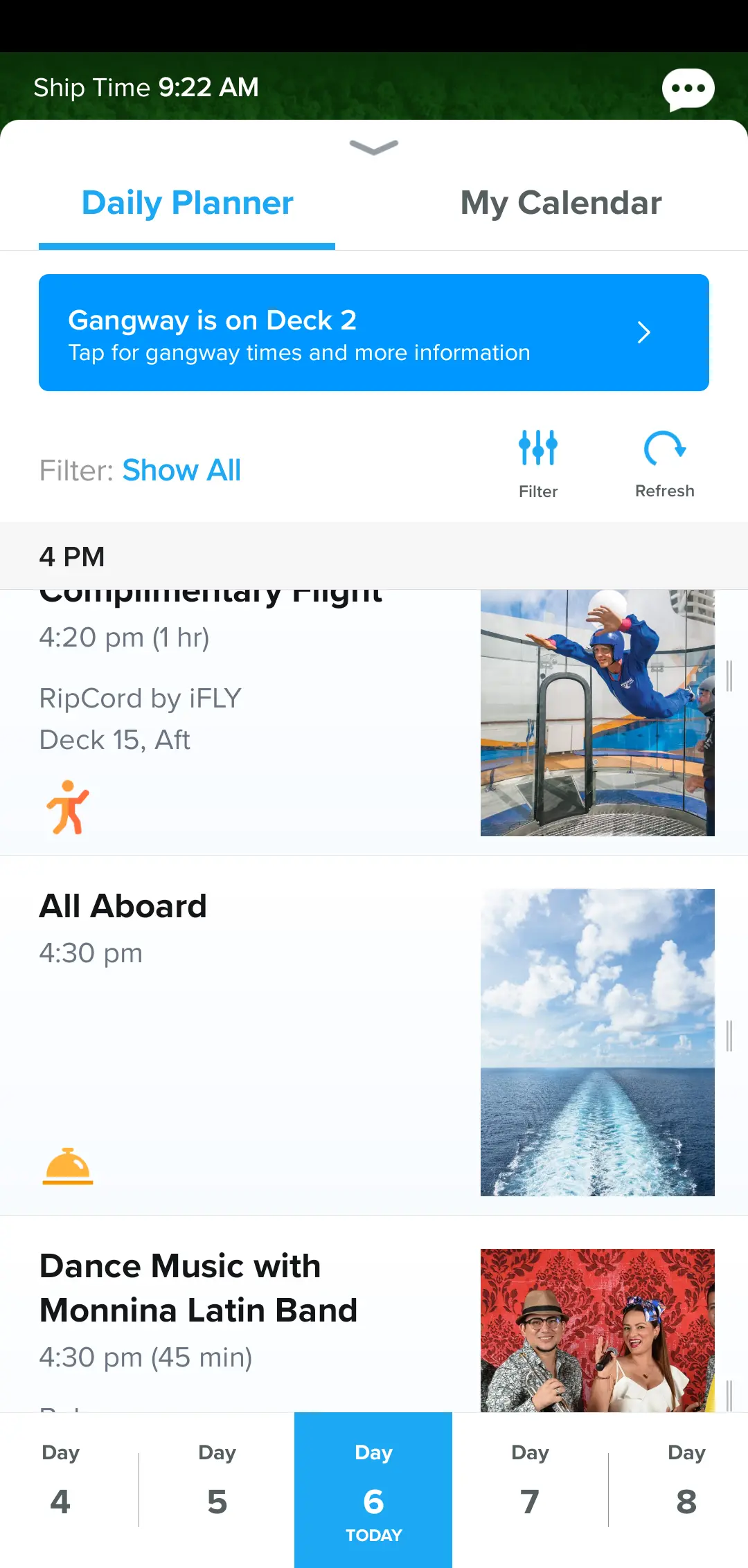

"[T]echnology and AI that make the experience more seamless and more personal," he added. "This approach expands the way guests can vacation with our family of brands and reinforces our vacation of a lifetime strategy."

For example, they aim to use technology to make vacations easier to discover and plan, improving overall guest satisfaction. Relevance and personalization directly correlate to what people are willing to pay for a premium vacation and pricey add-ons.

"We are improving our ability to curate and personalize what guests see while increasing pre-cruise engagement… The goal is to reduce friction, improve the experience, and present relevant options that add value to the guest," Liberty said.

In their eyes, AI isn't meant to replace the work of paid employees, either. Rather, when used correctly, it's a tool that can make their experience better and provide even more value.

Liberty continued, "We are also using AI to improve efficiency and execution, from supply chain forecasting to energy management and marine operations. These are the types of capabilities that build durable operating leverage over time and reinforce our focus on margin expansion and returns."