Is getting cruise travel insurance the right decision for your upcoming vacation?

When you're planning a cruise, there are plenty of costs to consider beyond the cruise fare: shore excursions, drink packages, wifi, and more. Protecting yourself against risk is one of those decisions, and the decision to purchase a plan depends on a few factors.

I've covered the cruise industry for many years, and unforeseen circumstances that lead to a last-minute cruise cancellation are probably right at the top of most common stories I've heard from readers. And it's usually the ones without travel insurance that end up writing a long winded post on a forum why they're stuck.

There are many kinds of cruise insurance policies to consider, so it's not a blanket purchase either. You have to look through the coverage choices before selecting the right one.

To make it simpler to understand, here's what you need to know about cruise insurance so you can pick the right option for you.

Why you need travel insurance for a cruise

It's not uncommon at all to hear someone brush off the need to buy travel insurance in the first place because they feel the risks are quite low.

I think many people equate travel insurance with health insurance to some extent. They think about having a heart attack, breaking a leg, or some other incident related to their health. If they're in good shape and free of pre-existing conditions, why bother?

While cruise insurance does cover health issues on a cruise ship, it is far more likely to be of use beyond a slip and fall.

Travel insurance covers many more scenarios related to you getting on a cruise, especially circumstances beyond your control.

- You lose your job

- Airline cancels your flight so you can't get to the cruise on time

- Lost baggage along the way

- Death in the family

- Last-minute severe illness

In all of those scenarios, they would occur in the final days or hours before your cruise begins, and if you tried to cancel your cruise, Royal Caribbean would offer you no refund.

Once you pass the final payment date for your cruise (90 days before your sailing for most cruises), you start incurring penalties if you were to cancel. In the final week before your cruise, there are no refunds for a cancellation. It doesn't matter how good of a story you have, and why it's not fair.

Travel insurance for a cruise would likely compensate you in those situations.

Then there's the really bad situations that could occur, such as getting severely hurt while on your trip. Car accident, falls, major health incidents, are all the kind of things that could require not only hospitalization, but transport by ambulance or helicopter. While your health insurance covers that at home, when you're out of the country you're likely out of network and the out-of-pocket costs can be outrageous.

Essentially, travel insurance for a cruise is peace of mind that a calamity will not financial burden you or leave you in a terrible bind.

Types of coverage offered by cruise travel insurance

Depending on which policy you choose, there are a great deal of coverages available with a plan purchase.

A common misconception is that travel insurance is just for medical issues, as it covers much more than that.

Most plans have coverage for the following categories:

- Trip cancellation & interruption

- Medical expenses

- Medical evacuation

- Luggage loss

- Travel delays

There's also some plans that have a "cancel anytime" option, which allows the insured person to have the coverage kick in for a reason not covered by the plan. These are pricier and usually cover up to 75% of the trip cost.

Most people will purchase a single trip insurance plan, where they want coverage for a specific vacation they are taking. There are also annual plans that are ideal for someone that vacations a few times per year.

How to choose the right cruise travel insurance policy

Cruise insurance policies are not all the same, so don't assume you can buy any plan.

You'll want to determine your risk factors and find a plan that matches up well with them.

If you have a medical condition, then it makes sense to find a plan that would cover that. Some policies will include or exclude certain pre-existing health conditions, so be sure to investigate which one works for you.

It's also a good idea to look at what each plan covers for trip interruption, delay, and cancellation. Specifically, what scenarios have to play out for your insurance to cover it. Never assume coverages, because nearly all cruise insurance requires something to occur out of your hands to be grounds for coverage.

It's a good idea to think of situations you're concerned about, and verify your plan would cover it.

Royal Caribbean sells its own Travel Protection Program, which is actually provided by a third-party company Aon Affinity. The cruise line doesn't own or operate the insurance, they simply offer it to its passengers as a courtesy.

There's certainly nothing wrong with Royal Caribbean's insurance plan, but don't assume it's the safest bet for your insurance needs. Moreover, read the policy just like any other policy.

Common exclusions in cruise travel insurance policies

Not every scenario is covered by travel insurance, so you want to double check what is not part of your plan. This means read your plan documents before you travel so you understand what kinds of things are excluded.

Typical exclusions are:

- Epidemics

- Your decision to cancel a trip before the cruise or flight is cancelled by the carrier

- Illness and injury caused by the use or abuse of alcohol or drugs, or any related physical symptoms.

- Mental or nervous health disorder, as recognized by the American Psychiatric Association, including but not limited to Alzheimer’s disease, anxiety, dementia, depression, neurosis, psychosis, or any related physical symptoms. (This exclusion applies only to trip cancellation coverage and trip interruption coverage)

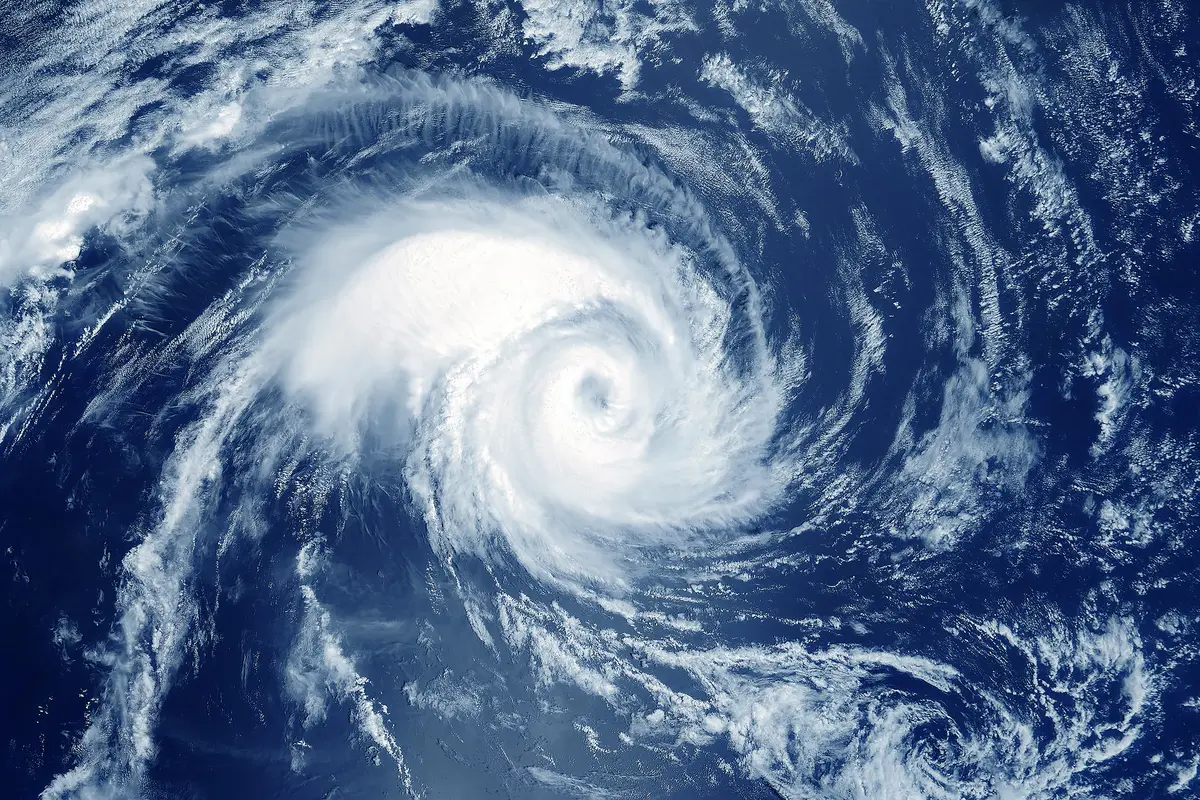

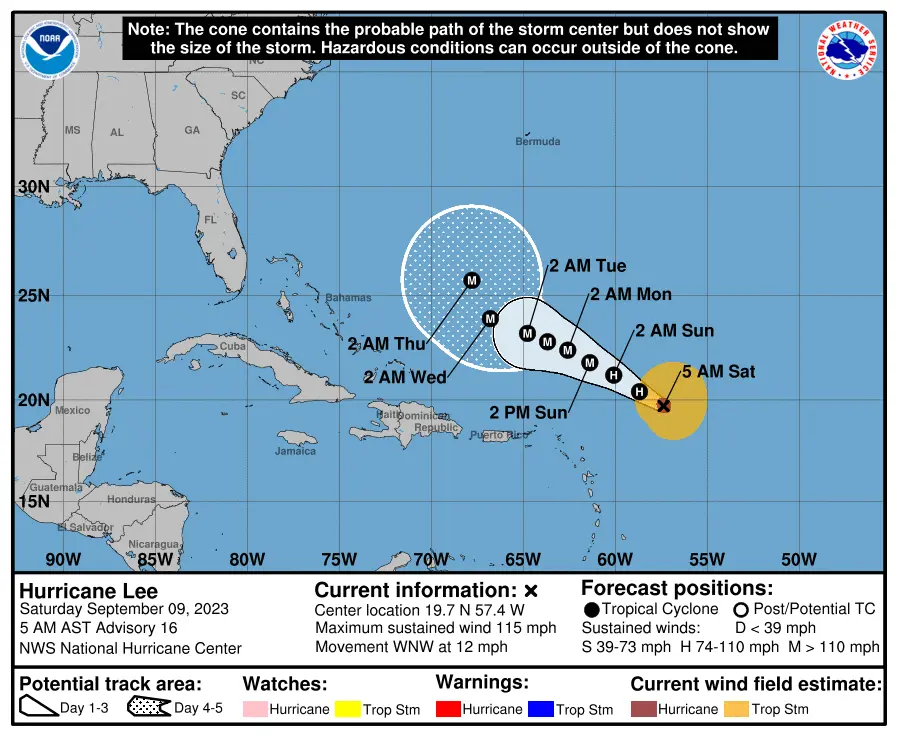

The most common issue with travel insurance is wanting to change your plans arbitrarily, especially during hurricane season.

What usually happens is there is a tropical storm somewhere in the Atlantic and someone booked on a cruise wants to cancel their trip. The cruise sailing and the flights haven't been changed or cancelled yet by the carrier, but they don't want to go anymore.

In that scenario, cruise insurance does not cover it, because your trip is still happening. The only situation in which an insurance policy would allow you to cancel at the last minute because you do not wish to sail is a "cancel for any reason" plan.

Tips for comparing cruise travel insurance plans

It's a really good idea to compare plans before buying one. There are many coverages and plan features that are anything but a "one size fits all" situation.

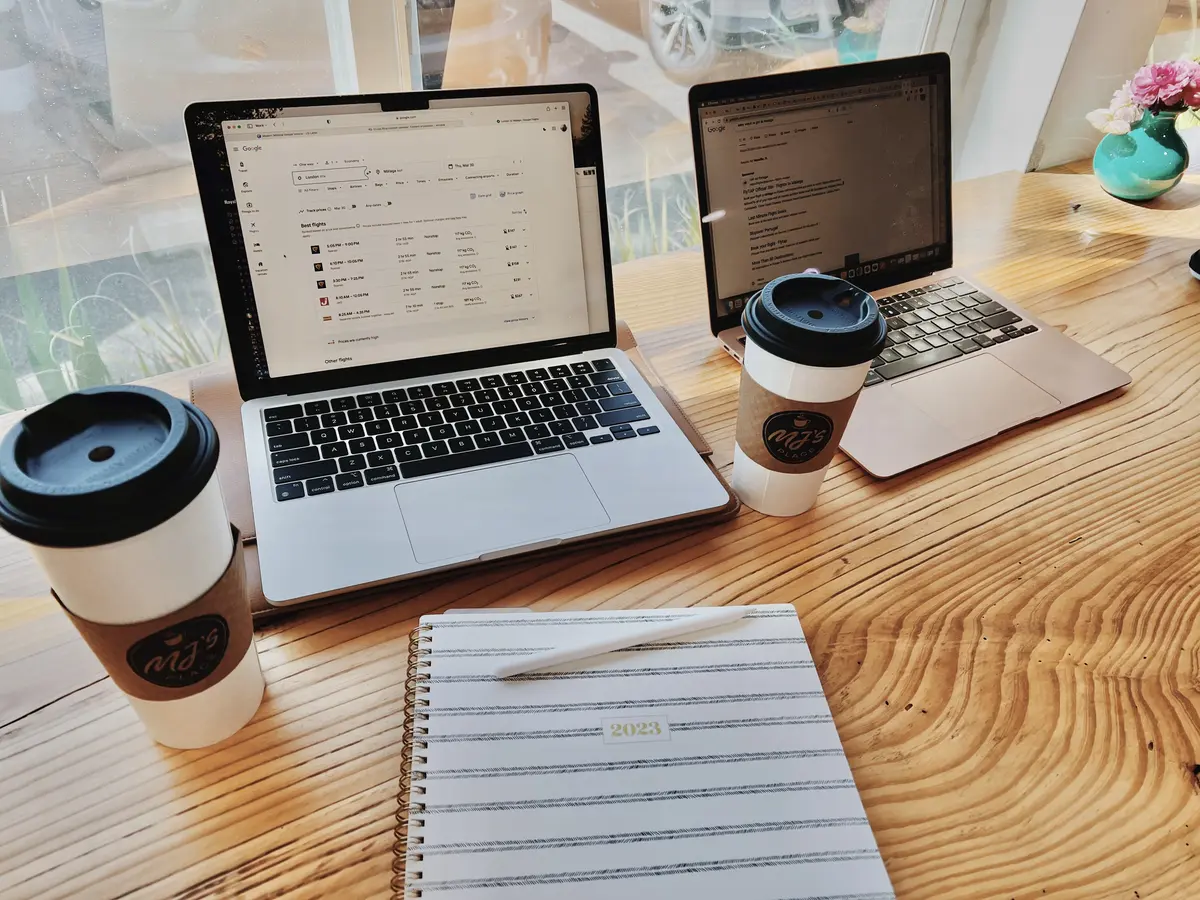

The best way to compare insurance plans is to go through a travel insurance aggregator. They make it simple and easy to see how plans differ, and often do a much better job of explaining what the coverages are without legal speak.

My two favorite options are InsureMyTrip.com and TravelInsurance.com. Both charge you nothing extra to use their services, so it's free to browse. Plus, they offer ways to compare specific plans from different travel insurance companies against each other.

When comparing insurance plans, look at which coverages you want and how much you want covered. Most importantly, verify what needs to happen for the coverage to kick in. It's a good idea to download the policy PDF document so you can read the fine print.

You can expect to find what percentage of the trip cost will be covered, as well as trip interruption. Baggage loss ranges from $500 to $1,500 per person, while medical evacuation ranges from $250,000 per person to $1 million per person.

You will also want to decide if you want a "cancel for any reason" policy. Adding it adds piece of mind, but it will drive up the cost of your policy, and it usually does not cover 100% of your trip cost.

The cost of cruise travel insurance

The cost of any travel insurance plan is dependent on how much your vacation costs, but the industry standard is around 4% to 8% of prepaid non-refundable expenses.

There are basic plans that are the cheapest, but don't cover nearly as much. Then there are expensive plans that cover a great deal of possible scenarios that will cost you even as much as 10% or more of your trip cost.

A cruise insurance policy is priced per person, and it depends on:

- Length of the trip

- Age of each traveler

- Number of people needing insurance

- Optional coverages you add (i.e. "cancel for any reason")

- Overall vacation cost

In 2023, Royal Caribbean listed 32 different price points for its insurance, based on the total vacation cost. Its cheapest plan was $39 for a cruise value up to $250 to a $1,799 policy for a cruise costing more than $14,001.

You can get a quote online from any trip insurance provider or broker with no obligation to purchase it.

How to file a claim with your cruise travel insurance

If you ever need to use your policy, there are important things to do so that you can have your claim covered. The U.S. Travel Insurance Association says about 90 percent of claims are honored.

The first thing to do is call your insurance company when you think you're about to do something that will be covered by the policy. It never hurts to ask to verify the scenario playing out is indeed covered, and what steps you should take along the way. Having the right documentation is important.

Speaking of documentation, you're going to need proof of a trip delay, cancellation or any event that will incur a claim. Keep any and all receipts, as well as notifications of changes in your plans. Emails and letters concerning a flight or cruise change, letters from a doctor or employer, and medical records are all good to have readily available.

In short, save receipts for everything, and ask for documentation for any medical or travel expenses.

Top travel insurance providers for cruises

There are lots of places to buy cruise travel insurance and plenty of providers, including your cruise line. Your travel agent may even offer an insurance policy that they recommend using (and can assist you in the event you make a claim). Then there's credit card protections and third-party aggregators.

Royal Caribbean's insurance

Royal Caribbean offers trip coverage that you can buy when booking your cruise.

Cruise line travel protection is usually not the most comprehensive plan available, but it's the easiest to book since it requires a simple check box to opt into at the time of booking.

Third party insurance

There are many different travel insurance companies, such as Travelguard, AIG Travel, Allianz Travel Insurance, and Travelex Insurance.

Third party insurance providers have multiple coverages, and do a good job of including pre- and post-cruise coverage as well. They are especially good if you are looking for extremely cheap or comprehensive plans. In general, you will find a great variety of policies and prices.

These are the sort of policies a travel aggregator website will include.

Credit cards

Premium credit cards usually include travel benefits that resemble a travel insurance plan.

Depending on your credit card, it may provide reimbursement in the event of a flight delay or cancellation, your baggage is damaged, or you have a family emergency that requires you to go home.

The two most popular credit cards offering travel protections are the Chase Sapphire Reserve card and the American Express Platinum card.

One "catch" with credit card protections is you must pay for the trip (sometimes completely) with the credit card you want to use for the benefits. You should also compare coverages against a regular travel insurance plan.

FAQs about Cruise Travel Insurance

What specific scenarios are covered under the "cancel for any reason" option in travel insurance policies?

The "cancel for any reason" option in travel insurance policies typically allows you to cancel your trip for reasons not covered by standard cancellation coverage, but there may be limitations, such as a deadline for cancellation and a partial refund.

How do pre-existing medical conditions affect the coverage and cost of cruise travel insurance?

Pre-existing medical conditions can affect coverage and may require a waiver for full coverage.

Are there any differences in coverage or cost for travel insurance based on the destination of the cruise, such as the Caribbean versus Alaska?

The cost and coverage of travel insurance can vary based on the destination, with some regions potentially having higher risks or costs associated with them.

The importance of being insured on your cruise

It's unlikely you'll ever need cruise insurance, but if you do, then you'll be so glad you bought a plan. Like all insurance, it's a waste of money until you need it.

Travel insurance varies considerably in coverages, and it's not cheap. But it provides peace of mind and more importantly, financial assistance should the unforeseen happen to you. It's more than a glorified medical plan, insurance is protection against major financial strife from an emergency.

Cruise ship plans can change, especially due to the weather or geopolitical incidents that occur in the final week or even days prior to a cruise sailing. Without insurance, you're on the hook for out of pocket expenses not refunded by the cruise line.

Most importantly, compare plans and policies to determine which is the best fit for you.

While not everyone may need insurance, it's something I believe is a good idea to have just in case. There are far worse things to spend your money on during your vacation, and the benefits cruise insurance provides can make the difference between a manageable problem and a nightmare.