Her $13,000 infirmary bill was higher than the cruise itself: Why one cruiser regrets not buying travel insurance

In:One woman's first cruise turned into a nightmare when she was slapped with a $13,000 medical bill after she began throwing up blood and losing consciousness.

Khiali Baxter was two days into her first-ever Royal Caribbean cruise with her boyfriend when she began feeling unwell.

"So, I woke up. I started throwing up blood, unfortunately, and I had passed out on the ground," Baxter told KHOU 11, "I could feel myself kind of going in and out of consciousness. I was very cold and terrified."

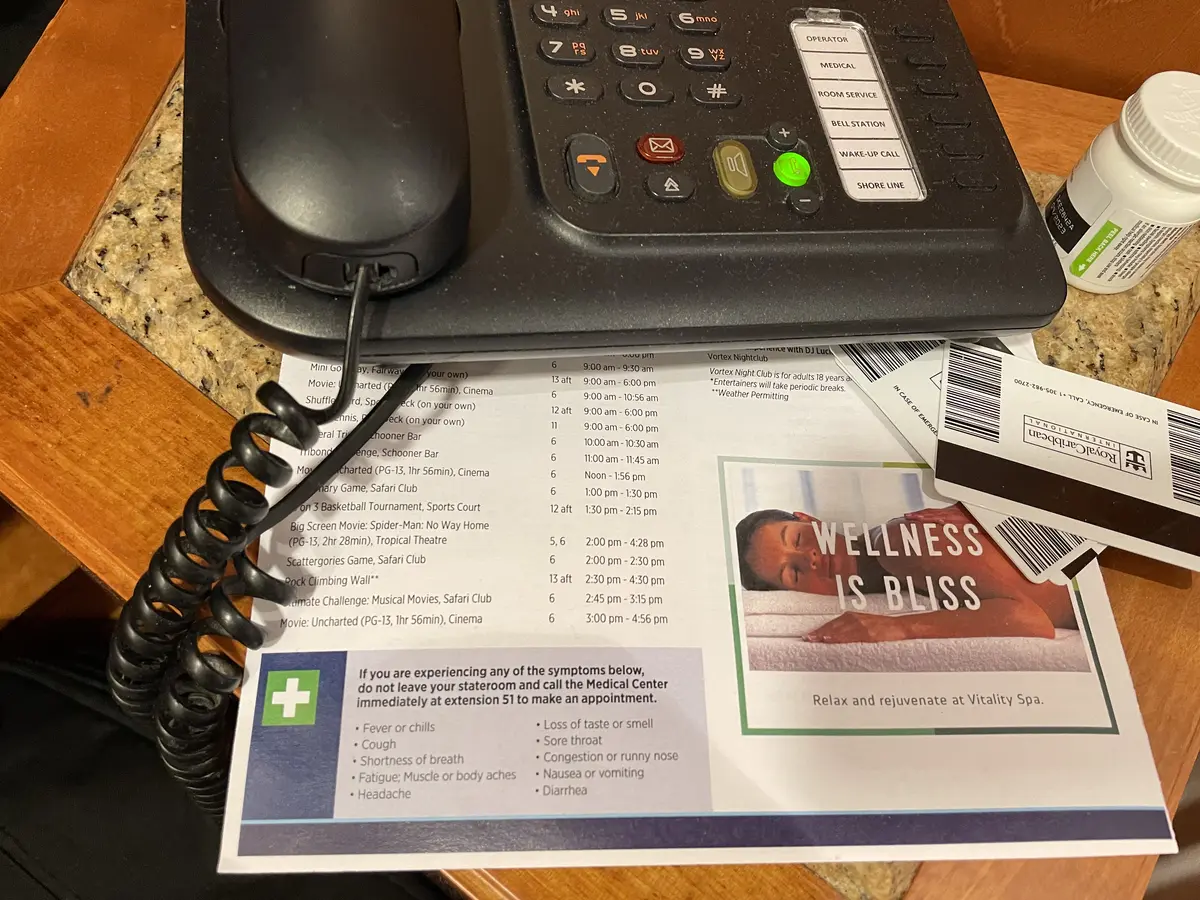

She was taken to the ship's medical facility, then transported to a hospital four hours away from the cruise port in Costa Maya — but not before waiting four hours onboard and racking up a $4,000 bill.

(Credit: Jennifer Brown/GoFundMe)

While at the hospital, Baxter received over $9,000 in medical care, including several different procedures to help stabilize her.

However, before they would treat her, the staff asked Baxter's family for payment. Baxter's father, Craig, recalled the conversation with a hospital employee in an interview with KHOU 11, saying they'd work as far as $2,500 would take them.

"I've never heard this in my life," he said.

(Credit: KHOU 11)

Back in Texas, Baxter's parents were scrambling to secure emergency passports to travel to Mexico.

The last-minute flights and accommodations weren't cheap, but they were not going to leave their daughter in a foreign hospital.

Travel insurance would have made a huge difference

(Credit: Jennifer Brown/GoFundMe)

Baxter was unaware of the steep out-of-pocket costs associated with international medical care and decided against travel insurance.

"It was a very, very scary experience, and my main thing that I do want to say is that I really wish I would’ve gotten travel insurance," Baxter said.

Travel insurance is a valuable but often overlooked safety net. Although it might seem like an avoidable expense, it's one of those things you don't want to use but are thankful for when you need it.

Read more: Travel insurance for a cruise: Why you need it for a Royal Caribbean cruise

(Credit: Jennifer Brown/GoFundMe)

A good insurance policy provides peace of mind in case of unexpected medical emergencies at sea. In Baxter's case, it would have helped recoup some of the expensive treatments she received, such as an endoscopy, colonoscopy, and blood transfusion.

Even though Baxter didn't have insurance, a family friend set up a GoFundMe. Over 160 generous donors have helped raise $14,138, or roughly 88% of the $16,000 goal.

Still, the family wants to share Baxter's story in hopes that it prepares others for the unexpected, especially when traveling far from home.

Travel insurance also helps cover things like lost luggage, travel delays, medical evacuations, and more. As such, the small upfront cost is worth the protection it provides during a costly emergency.

"It was an eye-opening experience that I hope prepares other young people," Craig Baxter said.

Unfortunately, Baxter isn't the only cruiser to be hit with a large medical bill

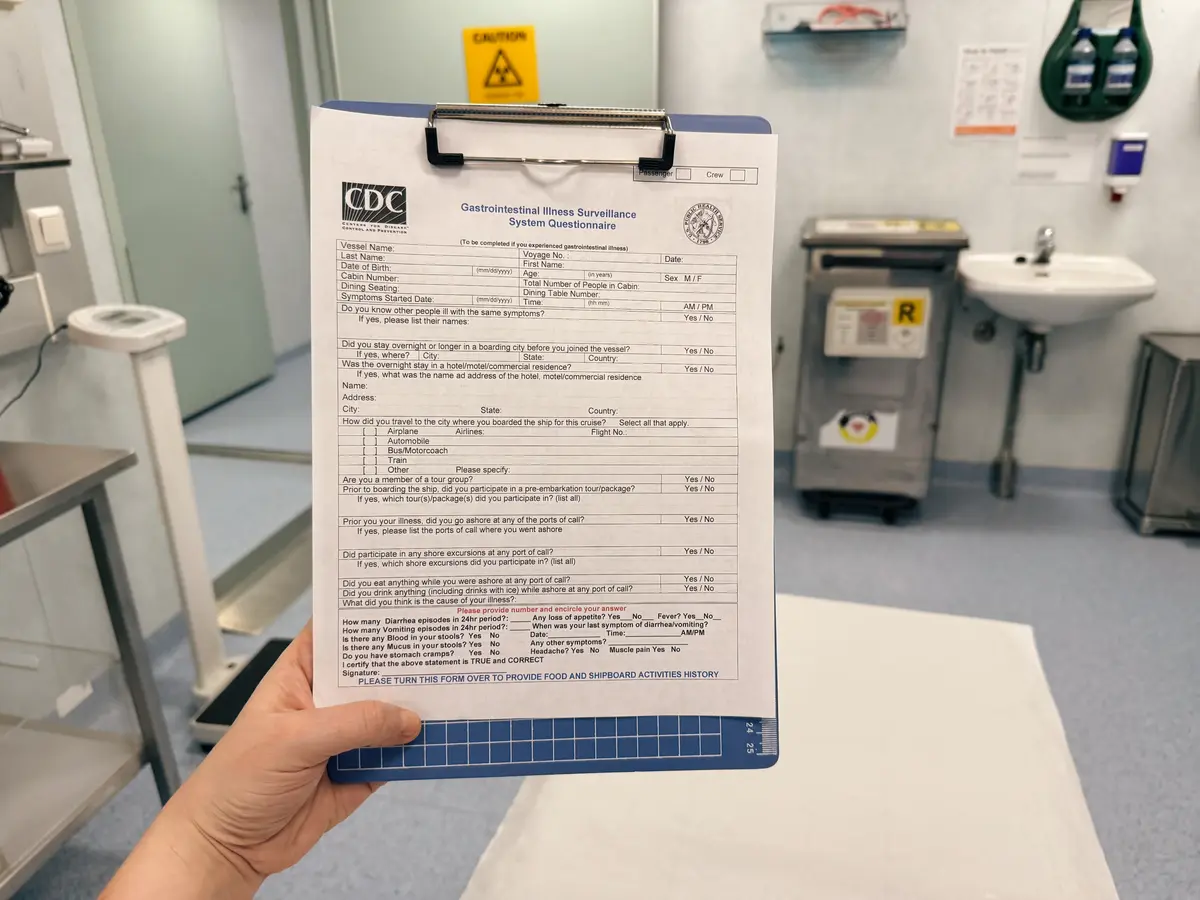

Vincent Wasney and his fiancée, Sarah Eberlein, were cruising on Royal Caribbean's Independence of the Seas when Wasney began suffering from a series of seizures. However, before the couple was allowed to disembark, they had to pay over $2,500 in medical bills.

As reported by KFF Health News and NPR, Eberlein heard Wasney make a pained noise before he had his first seizure. Blood began spilling from his mouth as a result of him accidentally biting his tongue.

Wasney's second seizure caused him to stop breathing, while the third seizure, characterized as a grand mal seizure, was even more severe.

The vessel was close enough to their disembarkation port in Florida, so they could disembark early via rescue boat — but not before paying a $2,500.22 medical bill.

The charges included $2,285.78 for general ward admission and observation, along with $97.99 for an i-STAT blood test, $104.55 for out-of-facility services, and $11.90 for medication.

Read more: Man was sick on a cruise and was hit with a big bill before being sent home