-

Posts

11 -

Joined

-

Last visited

Posts posted by MustCruise

-

-

Lanyards are great to have. You'll be changing clothes often, and your "available pockets" will fluctuate throughout the week. That's why so many people use cruise lanyards to create some consistency. You'll always know where to put your cruise key card and will be much less likely to lose it.

However... some people HATE wearing something around their necks constantly. We're a "cabin divided" - half wear lanyards and half use this brilliant little invention below. You'll never be without your phone and this creates next to 0 extra space. Your key card can piggy-back your most protected item all week long

UPDATE: i've been asked for the link where I bought this on Amazon. You can find this cruise key card holder here.

-

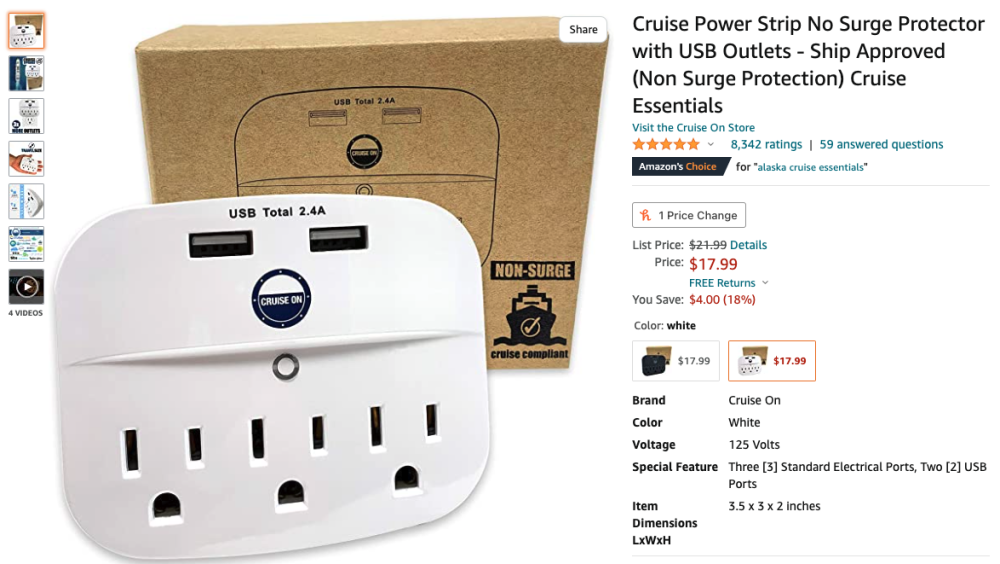

Please note - most of the recommendations below include devices with an extension cord. Royal Caribbean explicitly prohibits extension cords.

You can risk it and possibly get the device on... or, you might end up in an embarrassing altercation with ship security.

But, there's no reason to risk it.

There are perfectly good options that are fully compliant.

We've taken this one on dozens of cruises. It worked perfectly!

You can find this one here on Amazon: https://www.amazon.com/Cruise-Power-Strip-USB-Outlets/dp/B07BHVKPC3

-

We've been using tag holders for a decade plus. We've gone through a few cheapies and have found these below about five years ago. They're the same as mentioned above and far better than the alternatives. They'll last for longer than we will

You can them on Amazon here: Royal Caribbean Luggage Tags

-

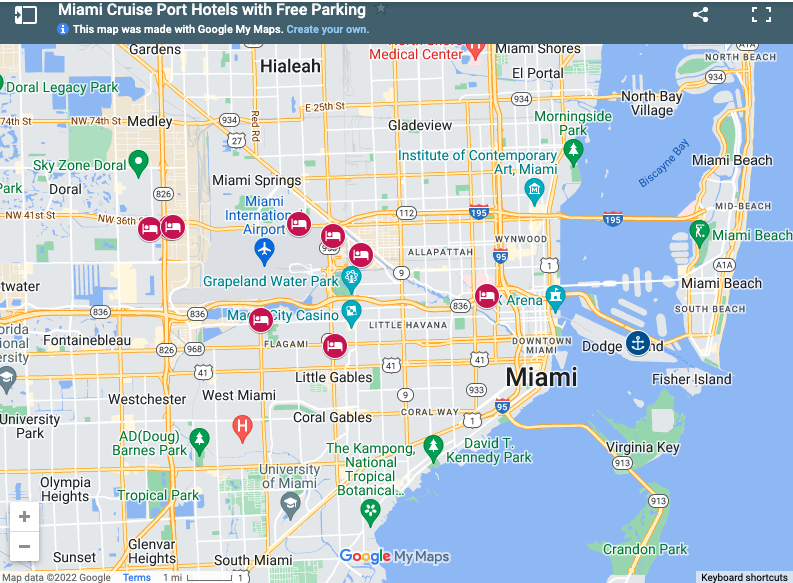

We booked the Element last time and it was great.

Here's a map with that and some other good options. The map and post also shows distances to and from Miami Cruise Port. I found it here: https://gangwaze.com/blog/hotels-near-miami-cruise-port-parking-shuttle-package

-

-

I bought this cruise tote bag a couple years ago and it's worked really well... it folds up nicely so I keep it tucked away for my port purchases!

-

-

4 minutes ago, JLMoran said:

Any investment in RCL, any other cruise line, has to be looked at with a timeframe of years at this point. And those years will likely have even more volatility than they've had before all the stuff hit the fan.

Chapter 11 doesn't mean the end of the company. It just means their debts get restructured and what's effectively a payment plan established so that the company can get back on its feet. It may require them to sell off some ships sooner than planned, or cancel / postpone plans for new ship builds or refurbishments. It will definitely cause a hit to the company's stock price if it happens, but it is also something that will recover over time if the company plays its cards right and rebuilds the business and brand. But it would take years to pull off if it happened, maybe even a decade with the negative sentiment around cruising right now.

I personally think owning stock in RCCL requires a few key things from each investor, especially right now:

- Believing that Royal is, at its core, still a solid company with a good product and plan to execute

- Researching their 10-Ks / 10-Qs to see how they've been doing financially, how they're using debt, etc.

- Getting as good an understanding as you can about the current debts they've taken on and how that could impact the company over the next few years (and this is probably the hardest part right now, because some of those instruments are confusing)

- Being ready to hold onto that stock for years and even decades before selling it off

- Being willing to keep doing the "homework" of keeping up with the company's financial announcements and general news

- And lastly, being ready to see more price drops (possibly big ones)

I was personally good with the first, fourth, and fifth points, and OK, if not thrilled, with the second. Trying to understand those debt instruments, though, was really hard for me. And being 10 years (hopefully, but could be 15) from retirement left me less willing to risk those big drops that might need a long time to recover.

Full disclosure: I work in the financial industry, but I am not in any way a financial professional or licensed investment manager. I'm just a guy who works in IT but has done my best to understand the stock market and how to properly invest.

Thanks for the thoughtful feedback, Joe!

I have no doubt that RCCL will survive the long term. And I have no problem holding stock for years or even a decade.

My only concern is that they'll need to wipe their balance sheet to stay alive and my stocks will go the way of the Titanic.

Like you, I'm very comfortable with the items you mentioned other than the financials. Those I just don't fully understand regarding long-term financial implications.

Again, thanks for the helpful thoughts!

-

29 minutes ago, ted52 said:

You have to be comfortable with what you are comfortable with. Only you can know what risk you are willing to take.

With that said personally, I think Royal's stock has plenty of room to continue to go down before it goes up. Then of course possibility of Chapter 11 but no one has a crystal ball. If you had told me in March that cruises would be canceled into the fall I would have said you were crazy but here we are.

Do what feels comfortable for you.

Thanks @ted52 - I guess this is part of my process to determine my comfort level. I'm reading as much as I can online, but value the feedback of this community as well.

-

I hate trading public equities but love Royal Caribbean.

With stock prices so deflated, I picked up a decent amount (for me) of RCL shares. My initial thought was to keep buying up more here and there to cost-average myself into a decent position. Then for the first time I thought, "what if RCCL goes Chapter 11?"

What are the chances? Any thoughts will be much appreciated!

Nassau - Is it even worth getting off the ship?

in Shore Excursions

Posted

We felt the same way our 5th, 6th, 7th time to Nassau...

Then we discovered RESORT DAY PASSES.

My favorite was the Hilton Colonial. They used to include drinks with their day pass for a really good price. Now, it's just access to their pool and chairs. But, it's great because it's walking distance.

We've tried a few of the options found here and have never had a bad experience.