One of the best travel credit cards is getting overhauled, and it’s no longer the best option for cruisers.

As a credit card enthusiast, I always strategize to find the best cards to align with my spending. Each purchase is meticulously charged to the best credit card, which we pay off in full each month to avoid interest charges and fees. It’s essentially a part-time job, but the rewards are substantial.

Last year, my husband and I saved over $23,000 thanks to our portfolio of credit cards. The bulk of this savings comes from redeeming our points for travel with airlines, hotels, and rental cars. And yes, I track our credit card savings each month - I am a data analyst, after all!

For many years, the Chase Sapphire Reserve used to be one of the best credit cards for earning points on cruise purchases. This was my top recommendation for cruisers for many reasons, including the card’s generous 3x point multiplier on travel. With this, you could easily rack up thousands of points with your cruise purchases.

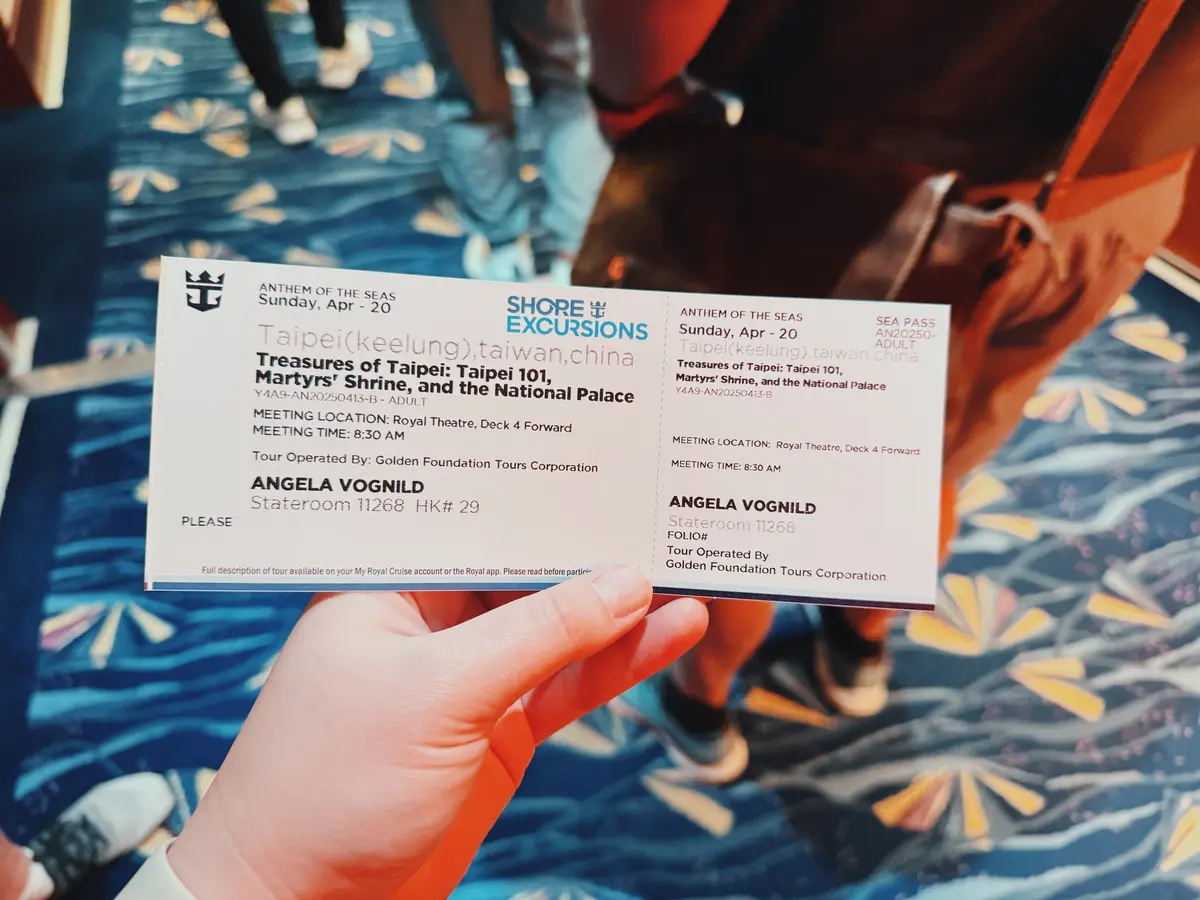

Because of this, the broad “travel” category earned 3x points on all cruise purchases. This included everything from your cruise fares to shore excursions, internet packages, specialty dining packages, spa treatments, and drink packages.

Unfortunately, the Chase Sapphire Reserve is receiving a drastic makeover, although most cardholders consider it a huge downgrade. Among many changes and restrictive redemptions, the broad 3x travel category is being eliminated.

If you’re wondering which credit card is now the best for cruise purchases, you’re not alone. I'm also personally impacted by these changes, and I am definitely not thrilled about it. Here are the travel credit cards I plan to use for cruising, including a few other options worth considering.

Here’s exactly what is changing with the Chase Sapphire Reserve

Chase recently announced a complete overhaul of the point-earning structure and provided benefits. Not only is the annual fee getting hiked from $550 to $795, but the 3x point earning on travel is being replaced with 4x points on airfare and hotels, but only when booked directly with the airline or hotel.

Removing the generic 3x points on all travel is a frustrating change for a top-tier travel card. For cruisers in particular, the removal of the 3x point benefit is a huge loss. Travel is easily my top spending category, so this downgrade was an unwelcome change for many.

Additionally, the travel category also included all transport, including taxis, ride shares, tolls, parking fees, and public transportation. Even better, the Chase Sapphire Reserve is a Visa with no foreign transaction fee. While traveling abroad and taking public transport, the Chase Sapphire Reserve was my most-used credit card to maximize the earning potential.

Instead, Chase is adding a bunch of lifestyle coupons, such as credits for DoorDash, Peloton, AppleTV, and StubHub. These credits are divided into monthly, quarterly, or bi-annual usage, making them more difficult to actually use.

How the change would directly impact your point-earning potential

For this example, let’s say you spent $2,000 on your cruise fare, along with $2,000 for shore excursions, internet access, and a drink package. With the old structure, you’d earn 3x points on $4,000 worth of cruise purchases.

With the 3x points offer, this would equate to 12,000 points of Ultimate Reward points with Chase. You could then redeem those points through the Chase Travel Portal for 1.5 cents per point.

For 12,000 points, this would be worth approximately $180 towards travel redeemed through the Chase Travel Portal. Additionally, you could transfer the points to various travel partners, such as many hotel chains and airlines. For me, 12,000 points could be redeemed with Delta Air Lines for a flight worth about $200.

Now, you’ll only receive 1x points on that purchase, which would equate to only 4,000 points on that same vacation. Redemptions are changing too, so you could only redeem those 4,000 points for $40 worth for most travel purchases.

There is an opportunity for “Points Boost” offers worth up to 2x points with “top picked hotels and flights with select airlines through Chase Travel,” and all other redemptions will be reduced to a 1:1 rate.

Rather than having the option to redeem your points on any travel, you are now limited to the select offers provided by Chase for hotels and airlines. This limits how your points can be redeemed, although most strategic cardholders will likely transfer points to travel partners.

What are the best credit cards now for cruisers?

With all the overhaul, you might not be wanting to pay $795 for the Chase Sapphire Reserve anymore; and honestly, I wouldn’t blame you. There are many travel credit cards on the market, and there might be one that fits your travel spending better.

Following the disappointing change to the Chase Sapphire Reserve, I’ve been researching the best credit cards for cruising purchases. I’ll also be adjusting my spending strategy, as I always charged my cruises to my Chase Sapphire Reserve.

Of course, one of the top competitors to the Chase Sapphire Reserve is the American Express Platinum Card. Unfortunately, American Express isn’t as widely accepted as Visa credit cards when traveling internationally. This is one of the reasons the Chase Sapphire Reserve was always my go-to card when traveling.

However, there are other options from both American Express and other credit card companies. Here are my top recommendations for cruising purchases moving forward, along with a few caveats to know.

American Express Green Card

If you still want to earn 3x points on cruise purchases, you should consider signing up for the American Express Green Card. This is considered one of the best replacements for the Chase Sapphire Reserve because of its 3x points on all travel and transit purchases.

Currently, the Amex Green has an annual fee of $150, making it more affordable than the Chase Sapphire Reserve. However, you will receive fewer luxury perks, such as the Priority Pass lounge access or the same level of travel insurance.

Another perk of the American Express Green Card is how well it pairs with other American Express credit cards. If you already have another Amex, all of your Membership Reward Points will be automatically pooled together.

For instance, I have the Amex Gold (for 4x points on groceries and dining), the Amex Green (for 3x points on travel and transit), and the Amex Platinum (for 5x points on airfare). All of these points are combined in my Amex account, which I can easily transfer to a partner airline for redemption.

The top spending categories for the Amex Green Card include:

- 3x points on travel: Cruises, airfare, hotel, campgrounds, car rentals, and vacation rentals

- 3x points on transit: Trains, taxicabs, rideshare services, ferries, tolls, parking, buses, and subways

- 3x points on dining: Worldwide dining, takeout, and delivery

Other benefits include the following:

- $199 CLEAR Plus credit

- Travel Delay Insurance

- Baggage Insurance

- Rental Car Loss Insurance

- No foreign transaction fees

For cruisers, the Amex Green is one of the best choices on the market now. You’ll still earn 3x points on all travel and transit charges, which rivals what you would have been receiving with the Chase Sapphire Reserve.

Wells Fargo Autograph and Autograph Journey

If you’re looking for another credit card with 3x points on all travel, Wells Fargo has two solid options to consider: the Autograph and Autograph Journey credit cards. Just like the Chase Sapphire Reserve, you can still earn 3x points on all travel and transit purchases, in addition to other categories like restaurants and gas.

The Wells Fargo Autograph credit card has no annual fee, while the Autograph Journey carries a $95 annual fee. With the Autograph Journey card, you’ll earn even more points on hotel and airline purchases. These accrued points can be redeemed for travel, gift cards, and statement credits.

This makes both credit cards excellent options to rack up points with cruise purchases, along with other cruise-related and travel expenses. The low annual fee means you have high earning potential with your travel purchases, and you aren’t tied to a travel portal for redeeming your points.

Additionally, you’ll receive some included travel protection with the Autograph Journey card for your cruising. This includes travel accident insurance, lost bag reimbursement, trip cancellation and interruption protection, and an auto rental collision damage waiver.

The Wells Fargo Autograph credit card includes 3x points on the following categories:

- Restaurants: Including dining in, takeout, catering, and delivery

- Travel: Airfare, hotels, car rentals, cruise lines

- Transit: Subways, ride shares, parking, tolls

- Gas: Gas stations and electric charging stations

- Streaming services and phone plans

The Wells Fargo Autograph Journey credit card includes the top spending categories and benefits:

- 5x points on hotels

- 4x points with airlines

- 3x points on travel and restaurants

- $50 annual statement credit: with a $50 minimum airline purchase

U.S. Bank Altitude Connect

Another travel credit to consider is the U.S. Bank Altitude Connect Visa Signature credit card. The credit card has no annual fee and includes a generous 4x points on all travel, although point redemption options are more limited. For casual cruisers not wanting to pay an annual fee for a credit card, this could be one of the best options.

You won’t be able to transfer your points to travel partners, but you can earn an eligible deposit into a U.S Bank account, along with some merchandise, travel, charity, and gift card options. Instead, you’ll want to think of this card as earning cash back for your travel purchases (around 2% to 4% essentially), which is a better option for casual cruisers who travel once or twice each year.

The top spending categories for the U.S Bank Altitude Connect include:

- 4x points on travel

- 5x points on prepaid hotels and car rentals booked with the Altitude Reward Center

- 4x points on gas stations and EV charging stations, up to $1,000 each quarter

- 2x points on dining, groceries, and streaming services

Other benefits include:

- 4 Priority Pass lounge visits each year

- $100 statement credit for TSA PreCheck or Global Entry every 4 years

- Basic travel interruption, delay, and cancellation insurance

Capital One Venture X

Another popular choice among travelers is the Capital One Venture X credit card, known for its premium travel benefits and strong earning potential. With an annual fee of $395, the Venture X is considered a more accessible option compared to other high-end travel credit cards.

Although the Venture X credit card doesn’t offer cruise-specific perks or bonus categories for cruises, this premium credit card shines when it comes to covering general travel expenses.

The Venture X credit card earns the most miles when booking travel directly through the Capital One Travel portal, including hotels, airfare, rental cars, and vacation rentals. But, you’ll still earn 2x miles on everyday spending, including cruising. However, if you prefer booking with airlines and hotels directly, you might not maximize your point-earning potential with this card.

Other noteworthy travel benefits include a $300 annual travel credit when booking through Capital One Travel, along with lounge access and a statement credit for either TSA PreCheck or Global Entry.

More importantly, your Capital One Venture X credit card offers strong travel protection that can provide peace of mind for your cruises. This includes trip cancellation, delay, and interruption coverage for unexpected circumstances. In addition, the Venture X has common carrier travel accident coverage, baggage insurance, and rental car collision coverage.

The top spending categories for the Venture X credit card include:

- 10x miles: When booking hotels and rental cars booked through the Capital One Travel portal

- 5x miles: When booking flights and vacation rentals booked through the Capital One Travel portal

- 2x miles: All other purchases

Some of the travel-related benefits and perks include:

- $300 annual credit towards Capital One Travel portal

- 10,000 annual bonus miles each anniversary

- $120 credit for PreCheck or Global Entry

- Priority Pass Lounge access

- Capital One Lounge and Landing Access

Bank of America Premium Rewards Credit Card

If you don’t want to spend hundreds of dollars on annual credit card fees, the Bank of America Premium Rewards Credit Card could be a great choice. With an annual fee of only $95, you’ll still receive some excellent travel perks and earn extra points on all travel purchases.

With the Bank of America Premium Rewards Credit Card, all travel and dining purchases earn 2x points while all other expenses earn 1.5x points. This means all cruise purchases would qualify for 2x points for all of your purchases. If you’re a member of the Bank of America Preferred Rewards loyalty program, you can earn even more points on travel purchases. This includes 25% to 75% boost in points, making the 2x points on travel increase to 2.5x to 3.5x points on travel.

Even better, the Bank of America Premium Rewards Card is a Visa credit card with no foreign transaction fees. That makes this credit card better suited for international travel, as Visa is widely accepted everywhere.

You will also receive flexibility for how you want to redeem your points. For instance, points can be redeemed for cash back in your Bank of America account or an eligible Merrill account (including 529 accounts). In addition, you could redeem points for a statement credit or gift cards through the Bank of America Travel Center.

Finally, you’ll receive travel insurance protections for delays, cancellations, interruptions, misplaced luggage, auto rental collision coverage, and baggage delays. The credit card also includes coverage for emergency evacuation and transportation for qualified events.

Other benefits for the Bank of America Premium Credit Card include:

- $100 statement credit for airline incidentals

- $100 statement credit for TSA PreCheck

- 10,000 annual bonus miles each anniversary

American Express Platinum Card

If you’re wanting to swap your Chase Sapphire Reserve for another top-tier, luxury travel credit card, then you might want to consider the American Express Platinum Card.

Regarded by many as the best travel credit card, the Amex Platinum is heavy on the benefits, but not necessarily as strong with earning potential. Currently, the Amex Platinum has an annual fee of $695, but many speculate this will be increased to align with the Chase Sapphire Reserve.

The top spending categories on the Amex Platinum include 5x points on all airfare purchases and prepaid hotels, but only 1x points for all other travel. While that’s not necessarily impressive, there are other lucrative cruise and travel perks that could be worthwhile, including access to many different airport lounges.

With the Amex Platinum, you are eligible to receive perks through the Cruise Privileges Program (CPP). When you book a cruise five nights or longer through the Platinum Travel Service, you can receive onboard credit between $100 to $300 per stateroom. The Cruise Privileges Program also provides unique amenities for each cruise line, along with 2x points on each dollar you spend per booking with American Express Travel.

Another enticing perk with the Amex Platinum is the comprehensive travel insurance for trip delay, cancellation, and interruption. Some of the most important coverage with the American Express Platinum Card includes medical assistance, which provides emergency medical coverage up to $250,000, evacuation up to $100,000, and accident insurance up to $500,000 in the event of injury. Luggage protection is also provided, and cruise ships are specifically mentioned in the coverage.

Additionally, you’ll receive many travel-related benefits with the Amex Platinum as well, including:

- $200 Airline Fee Credit: Baggage fees and other incidental credits

- $200 Hotel Credit: Select hotels prepaid through the Amex Travel portal, includes Fine Hotels & Resorts and Hotel Collection

- $200 Uber Credit: Available monthly in your Uber account

- Global Lounge Access: Access to the Delta SkyClub, Amex Centurion Lounges, and Priority Pass lounges

- TSA Precheck, Global Entry, and CLEAR Plus Membership