Royal Caribbean Group released its first quarter 2021 results on Thursday, along with a business update on where things stand right now related to the global health crisis.

While Royal Caribbean did lose $1.1 billion or $4.66 per share compared to US GAAP Net Loss, that is an improvement over the same time last year, when it lost $1.4 billion.

The Company also reported Adjusted Net Loss of $1.1 billion or $4.44 per share for the first quarter of 2021 compared to Adjusted Net Loss of $310.4 million or $1.48 per share in the prior year.

Royal Caribbean Group's monthly cash burn is approximately $300 million, which is slightly higher than the previously announced range driven mainly by fleet wide restart expenses and timing.

Positive outlook

The biggest difference in this quarter versus last quarter is the anticipated summer sailings that will begin as early as June.

A total of 11 ships across all of Royal Caribbean Group's brand will sail from the Caribbean and Europe, in addition to the four ships already sailing.

The company said reaction to the new sailings has been "positive".

These cruises are taking place with adjusted passenger capacity and the enhanced health protocols developed with government and health authorities, and guidance from the Healthy Sail Panel.

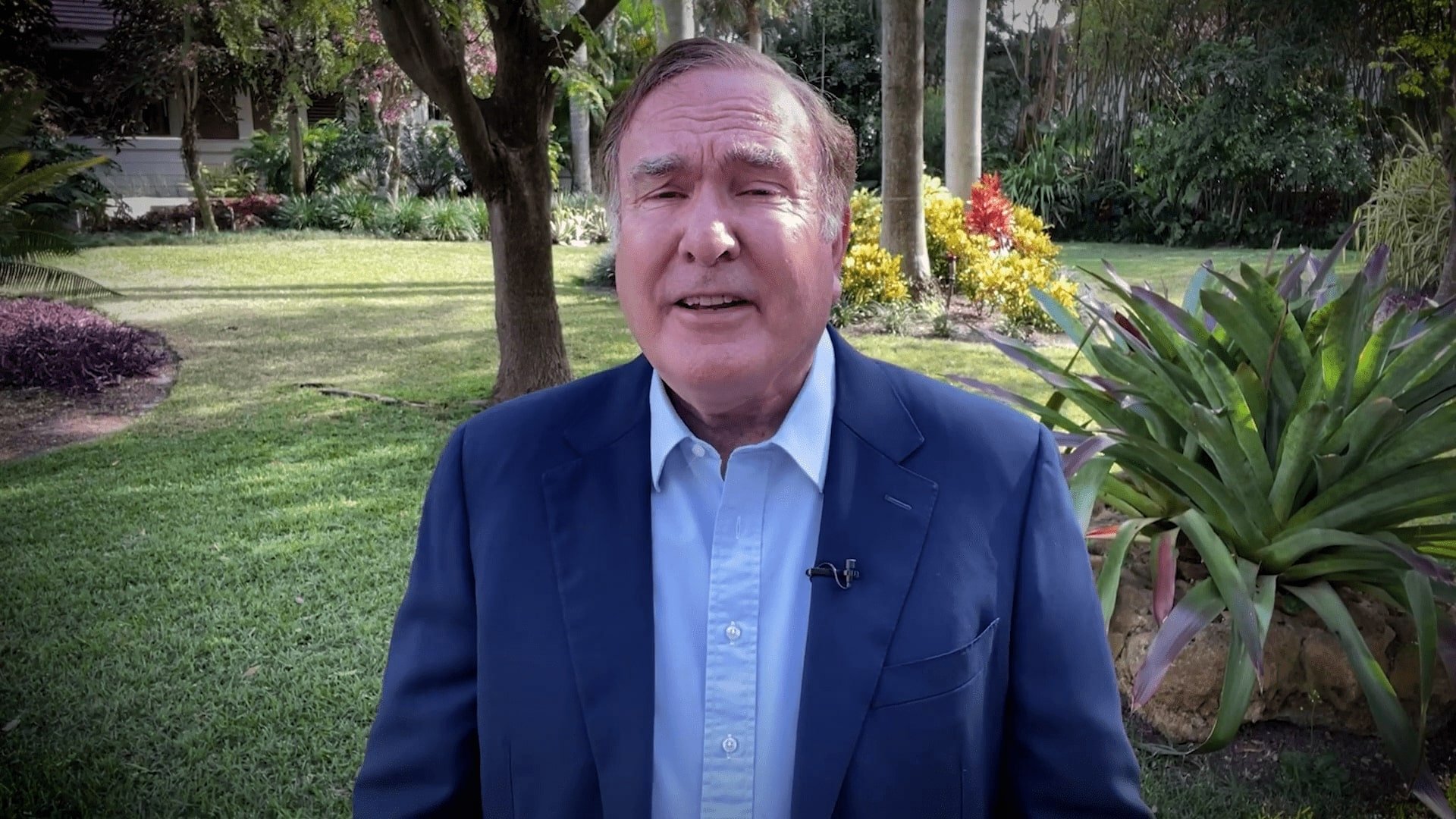

Royal Caribbean Group Chairman and CEO Richard Fain also talked about the new letter from the CDC which gave a more favorable possibility of cruise ships resuming sailings from the United States this summer.

"Last night, the CDC notified us of some clarifications and amplifications of their Conditional Sail Order which addressed uncertainties and concerns we had raised," Mr. Fain said in a statement.

"They have dealt with many of these items in a constructive manner that takes into account recent advances in vaccines and medical science."

"Although this is only part of a very complex process, it encourages us that we now see a pathway to a healthy and achievable return to service, hopefully in time for an Alaskan season."

Cash outlook

With quarterly losses measured in the billions of dollars, one of the many concerns about the health of the company has been cash flow.

Royal Caribbean Group has raised approximately $12.3 billion through a combination of bond issuances, common stock offerings and other loan facilities.

Among the actions taken during the first quarter of 2021 to help include:

- Completed a $1.5 billion equity offering at a price of $91 per share;

- Issued $1.5 billion of 5.5% senior unsecured notes due 2028, the proceeds of which have been and will be used to repay principal on debt maturing or required to be paid in 2021 and 2022;

- Amended its $1.0 billion term loan due April 2022 to extend the maturity date for consenting lenders by 18 months and, in connection therewith, repaid $138.5 million of principal on the facility using proceeds from the senior notes;

- Amended its $1.55 billion revolving credit facility due October 2022 to extend the maturity date for consenting lenders by 18 months and, in connection therewith, repaid $277.6 million of principal on the facility using proceeds from the senior notes (with a corresponding reduction in commitments);

- Completed the balance of the previously announced amendments to its export credit facilities, which in total defer $1.15 billion of principal amortization due before April 2022 and waive financial covenants through at least the end of the third quarter of 2022 and;

- Amended the majority of its commercial bank facilities and credit card agreements to waive financial covenants through at least the end of the third quarter of 2022.

As of March 31, 2021, the Company had liquidity of approximately $5.8 billion, including $5.1 billion in cash and cash equivalents and a $0.7 billion commitment for a 364-day facility.

Bookings update

Royal Caribbean Group reports booking activity for its 2021 cruises are, "aligned with the Company's anticipated resumption of cruising."

Pricing on these bookings is higher than 2019 both including and excluding the dilutive impact of future cruise credits (FCCs).

Cumulative advance bookings for the first half of 2022 are within historical ranges and at higher prices when compared to 2019. This was achieved with minimal sales and marketing spend which the Company believes highlights a strong long-term demand for cruising.

As of March 31, 2021, the Company had approximately $1.8 billion in customer deposits, in line with its December 31, 2020 balance. Approximately 45% of the customer deposit balance is related to FCCs.

Since the suspension of guest operations on March 13, 2020, approximately 50% of the guests booked on cancelled sailings have requested cash refunds.